Choose the Right Entity to Set Up

| Business Type Items | Company ( Company Limited by Shares/Limited Company ) | Branch Office of a Foreign Company | Representative Office |

|---|---|---|---|

| Permitted activities | General trading, sales and manufacturing | General trading, domestic sales and manufacturing | Legal acts and liaison activities |

| Income Tax | 20% | 20% | Not applicable |

| Profit remittance tax | Withholding tax of 21% | None | Not applicable |

| Tax incentives under the Statute for Industrial Innovation | Applicable | Not applicable | Not applicable |

| Extent of the liability of a shareholder/head office | Shareholders are liable to the extent of their capital contribution to the company. | Foreign head office is liable for any liabilities unsettled by the branch. | Not applicable |

| Requirement for shareholder(s)/responsible person | Must have at least 1 corporate shareholder or 2 individual shareholders ( 1 or more individual or corporate shareholders in the case of a limited company ). All shareholders may be foreign nationals residing outside of Taiwan | Not required to have shareholders but required to register a responsible person | Not required |

| Requirement for director(s) | Must have at least 3 directors ( between 1 and 3 in the case of a limited company ). All directors can be foreign nationals residing outside of Taiwan. | Not required | Not required |

| Requirement for supervisor(s) | Must have at least 1 supervisor ( no requirement in the case of limited company ) who can be a foreign national residing outside of Taiwan. | Not required | Not required |

| Minimum capital requirement or minimum operating capital requirement | No minimum requirement, but the capital still needs to be examined and certified by a local CPA and covers at least the incorporation cost (Note 1) | No minimum requirement, but the capital still needs to be examined and certified by a local CPA and covers at least the incorporation cost (Note 1) | Not required |

| Sources of capital contribution | Capital contribution can be made in cash or thru capitalization of retained earnings or capital surplus. | Initial operating capital must be remitted in Taiwan from the offshore head office. Subsequent contribution of additional operating capital can be made through remittance from offshore head office or thru capitalization of the branch retained earnings. | Not applicable |

| Filing of annual income tax return | Required | Required | Not required |

| Withholding tax on salaries, rental income, professional fees, and other income payments. | Required | Required | Required |

| Allocation of administrative expenses by parent / head office | Subject to a 20% withholding tax. The deductibility of this allocation for tax reporting purposes will depend on the adequacy of the supporting documents thereon. | Normally not subject to 20% withholding tax and can be treated as a tax deductible item if certain criteria are met. | Not applicable |

| Keeping of accounting books and records | Required | Required | Required |

| Liquidation of the entity following completion of dissolution | Required | Required | Not Required |

| Purchase of real property and automobiles in the name of subsidiary / branch / representative | Permitted | Permitted | Not Permitted |

Note 1. If the business entity engages in activities that require a special permit or approval, the authorities may set a higher capital requirement

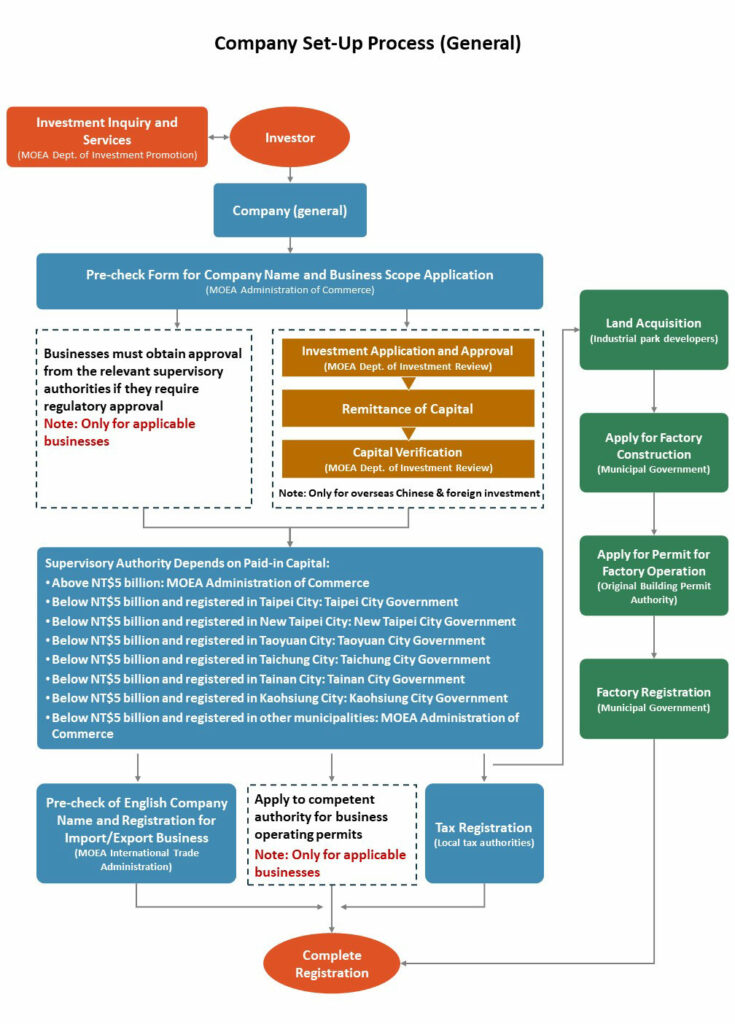

Company Set up Process

Pricing Reference

Setup Package — From USD 3,000

Company registration, MOEAIC approval, Bank account opening

Compliance Package — USD 400 / month

Bookkeeping coordination, Tax filing coordination, Payroll compliance monitoring

Indicative starting rates for Growth Partner project coordination services. Final pricing depends on scope, regulatory requirements, and professional service providers. Growth Partner does not provide legal or CPA services directly; such services are delivered by independent licensed firms.

Not sure where to start? Let’s figure it out together.

If you are unsure about which entity to choose for your Taiwan business, please schedule a call with us, and we’ll assist you in selecting the plan that best meets your needs.